Discover the Axis Bank Privilege Credit Card with free airport lounge access, dining discounts, milestone rewards, and more. Apply now under the limited-time Lifetime Free offer.

Axis Privilege Credit Card Review – Benefits, Fees, and Lifetime Free Offer

If you’re looking for a premium credit card that offers airport lounge access, milestone rewards, dining discounts, and exclusive travel perks, the Axis Bank Privilege Credit Card is worth exploring. In this article, we’ll break down the fees, charges, and benefits of the card so you can decide whether it’s the right choice for you.

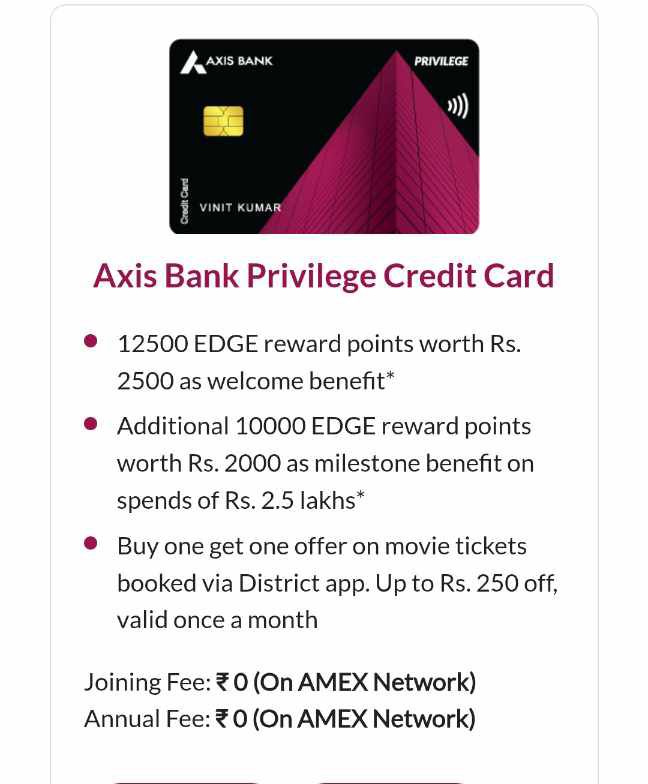

Fees and Charges

- Annual Fee: Currently, Axis Bank is offering the Privilege Credit Card as Lifetime Free under a limited-time offer. Normally, the annual fee is ₹1,500 + GST.

- Finance Charges: If you miss paying your bill, an interest of 3.75% per month will be applied.

- Forex Markup Fee: 3.5% of the transaction value on international spends.

👉 Pro tip: If you want to avoid the annual fee, this is the best time to apply since it’s being offered as Lifetime Free.

Key Benefits of Axis Privilege Credit Card

1. Welcome Benefits

- Get 12,500 EDGE Reward Points as a welcome gift when you pay the joining fee and make your first transaction within 30 days.

- Note: This benefit is not available on Lifetime Free cards.

2. Milestone Benefits

- Spend ₹2.5 lakh annually and earn 1,000 EDGE Reward Points.

- Additional milestone benefit of 2,500 EDGE Reward Points on higher spends.

3. Complimentary Domestic Airport Lounge Access

- Get 2 complimentary lounge visits per quarter (8 per year).

- Enjoy free Wi-Fi, snacks, beverages, and a comfortable waiting area worth approx. ₹1,000–₹3,500 per visit.

4. Dining Benefits

- Up to 25% discount (max ₹800 per transaction) at partner restaurants under the Dining Delights program.

5. Reward Points on Spends

- Earn 10 EDGE Reward Points per ₹200 spent.

- Reward points can be redeemed for vouchers, travel, shopping, and more.

6. Insurance Coverage

- Purchase Protection: Coverage up to ₹1,00,000.

- Credit Shield: Coverage up to ₹1,00,000.

- Lost Travel Documents: Coverage of USD 300.

- Loss/Delay of Checked Baggage: Coverage up to USD 500.

7. Wednesday Delight Offer

- Up to 15% off on flight and hotel bookings made via Goibibo, MakeMyTrip, and Yatra on Wednesdays.

- Exclusive offers on Flipkart, Amazon.ae, and other platforms.

8. Fuel Surcharge Waiver

- 1% fuel surcharge waiver on transactions between ₹400–₹4,000 at all fuel stations across India.

- Maximum benefit capped at ₹400 per month.

Who Should Apply?

The Axis Privilege Credit Card is ideal for:

- Frequent travelers who use airport lounges.

- Foodies who enjoy dining discounts.

- Shoppers looking for milestone and reward benefits.

- Users who want a lifetime free credit card with premium perks.

Final Verdict

The Axis Bank Privilege Credit Card packs excellent value with its lounge access, milestone rewards, dining discounts, and Wednesday Delight offers. If you grab it under the Lifetime Free offer, it’s a no-brainer.

✅ High approval chances

✅ Lifetime Free (limited period)

✅ Great for travel & lifestyle benefits

👉 If you want to apply, check the official link from Axis Bank

Also read: Flipkart Axis Bank Credit Card Review 2025 – Cashback, Fees & Benefits